Enhancing Operational Efficiency Through the Importance of Risk Management

The Relevance of Comprehending the Relevance of Risk Management in Different Industries

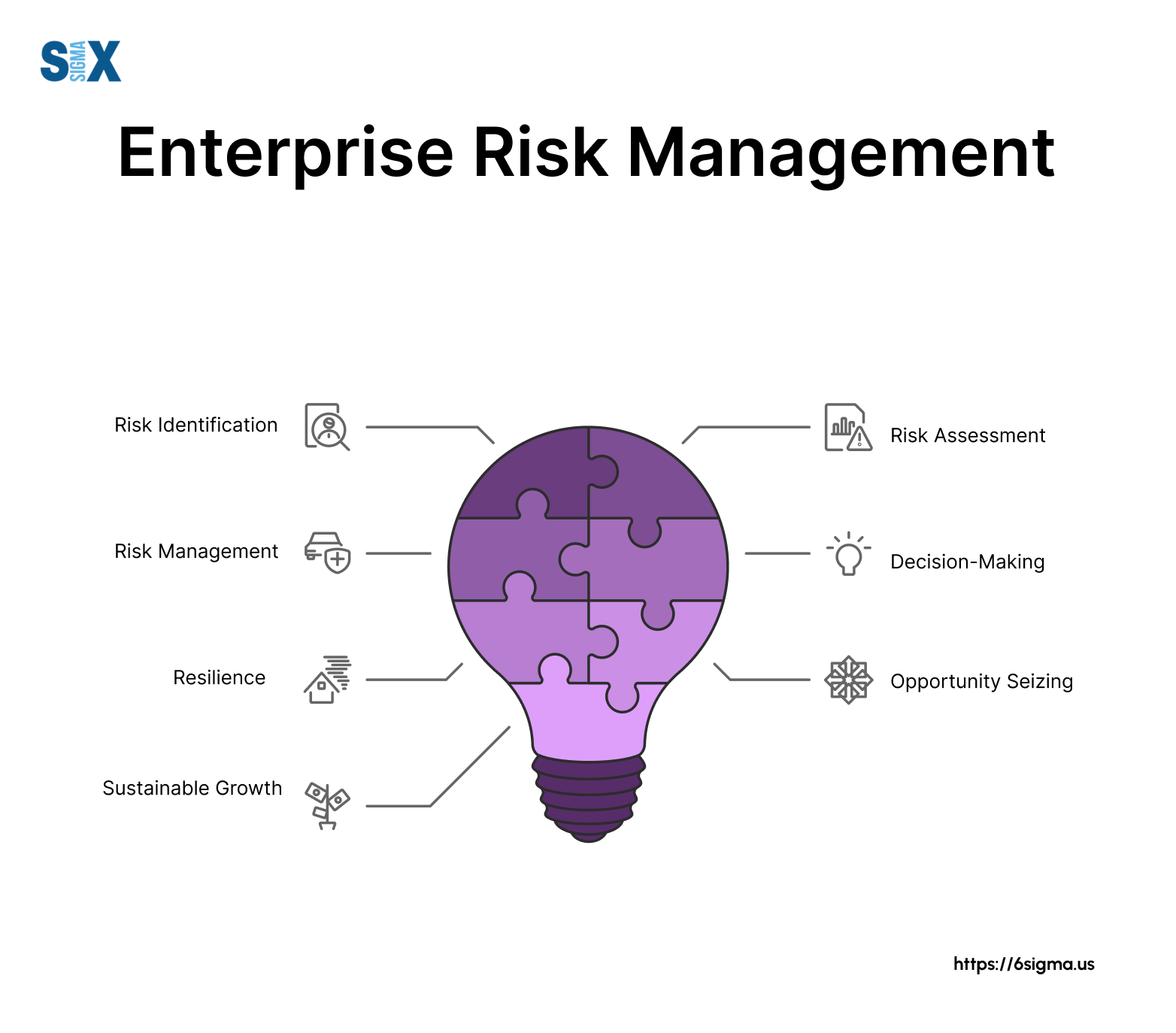

The Core Concept of Risk Management and Its Objective

Risk Management, the foundation of several markets, hinges on the recognition, evaluation, and mitigation of uncertainties in a service setting. It is an essential method that allows organizations to guard their assets, credibility, and total survival. By properly determining possible risks, organizations can create approaches to either avoid these risks from occurring or decrease their influence. The evaluation procedure involves analyzing the likelihood and potential seriousness of these dangers. As soon as risks have been recognized and evaluated, the reduction process involves developing approaches to reduce their possible impact. This procedure is cyclical and continuous, ensuring that organizations are prepared for the ever-changing nature of Risk in different markets. The main objective, thus, is to foster durability among unpredictabilities.

Benefits of Implementing Risk Management in Organization Operations

Revealing the Role of Risk Management in Different Industries

While every industry challenges its unique collection of threats, the application of Risk Management approaches remains a common denominator in their quest of sustainability and growth. In the healthcare sector, Risk Management involves ensuring patient safety and security and information defense, while in This Site money, it entails mitigating investment threats and guaranteeing governing compliance. learn this here now Inevitably, the function of Risk Management across sectors is to identify, analyze, and minimize dangers.

Real-life Case Research Studies Showing Effective Risk Management

To understand the relevance of Risk Management in these lots of fields, one can look to several real-life circumstances that highlight the successful application of these steps. Toyota, post the 2011 earthquake in Japan, modified its supply chain Management to reduce interruption risks. These instances show how markets, learning from situations, efficiently used Risk Management strategies to decrease future dangers.

Future Fads and Growths in Risk Management Methods

As the globe remains to progress, so also do the fads and growths in Risk Management approaches. Quick improvements in modern technology and data analytics are improving the Risk landscape. Big information and AI are currently instrumental in forecasting and alleviating risks. Organizations are leveraging see post these devices to develop predictive designs and make data-driven choices. Cybersecurity, once a peripheral concern, has actually catapulted to the forefront of Risk Management, with approaches concentrating on response, discovery, and prevention. The combination of ESG (Environmental, Social, Governance) elements into Risk Management is another growing trend, reflecting the increasing recognition of the duty that ecological and social risks play in organization sustainability. Thus, the future of Risk Management lies in the blend of advanced innovation, cutting-edge techniques, and an all natural method.

Conclusion

Finally, recognizing the importance of Risk Management throughout a spectrum of markets is vital for their durability and prosperity. Customized approaches can help minimize potential risks, safeguard properties, and foster stakeholder depend on. Furthermore, aggressive decision-making help in regulative conformity and maximizes source use. Ultimately, effective Risk Management contributes to more lasting and resilient businesses, highlighting the relevance of this practice in today's highly affordable and dynamic organization environment.

While every industry challenges its special collection of dangers, the execution of Risk Management approaches continues to be an usual in their search of sustainability and development. In the healthcare field, Risk Management involves making sure patient safety and security and data security, while in finance, it includes mitigating financial investment dangers and guaranteeing regulatory conformity. Ultimately, the duty of Risk Management across markets is to determine, evaluate, and alleviate risks. These instances demonstrate how markets, discovering from dilemmas, effectively applied Risk Management approaches to decrease future dangers.